Reducing Outbound Shipping Costs

After labor and the cost of goods sold (COGS), order fufillment logistics is often the largest bucket of costs for ecommerce retailers. Within that, outbound shipping can be anywhere from 50%-70% of total costs. That’s a lot! Therefore, focusing on thecost reduction of outbound shipping costs is one of the best ways to meaningfully improve margins and cash availability. Fortunately, there is a an excellent play to reduce between 1%-2% on average—arbitrage across carriers.

The following playbook is for operations managers looking to save as much money as possible on their outbound logistics management.

What drives outbound delivery costs for enterprise operations?

Outbound shipping costs are mostly influenced by the rates available to you via carriers in which you have a contract. Contracts are often non-standard, and will have some combination of volume thresholds, methods, package dimension definitions, and geographical zoning rules.

Carriers are the usual suspects, like USPS, FedEx, and UPS, but they can also be regional or local carriers. In fact, there is a whole world of localized carriers who can provide major cost saving opportunities, which we’ll get into in a moment.

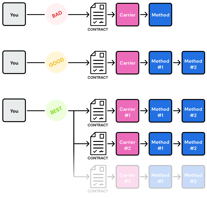

Most ecommerce companies will go directly to a carrier and negotiate contract rates with them, but it doesn’t have to be this way. Often, alternative contracts and rates are available to you:

- Through your 3PL, who might have their own contracts with national or local carriers.

- Through independent consultants, who act on your behalf to negotiate rates with a carrier. Often the model is they are the ones who have the contract with the carrier and sell through to you.

- Through a specialized vendor, who is a lot like a consultant, but has more of a product orientation. ShipStation is the largest and most prevalent. They effectively act as a “Group Purchasing Organization” (GPO) found in the healthcare insurance industry, where the consultant secures contracted rates with carriers under the assumption of some generalized volume load, and then the consultant turns around and sells the rates at a cost-plus model.

- Through a different software platform which might include shipping capabilities. An example is Shopify, which offers sell-through rates from USPS, UPS, and DHL.

There is no right way to manage shipping and secure great carrier contract rates. In fact, the guiding principle for shipping cost reduction is “more is more.”

The single biggest myth with shipping is that one carrier or method is the best. There is no universal best rate. Ecommerce companies can be lulled into thinking that, especially from a sales rep at one of the carriers. They will pitch volume breakage discounts, or throw intimidation at using other order fulfillment options. Operators will become fixated on a single rate thinking they have the best available rate for them, and therefore if they ship everything through that, they are saving the maximum amount of money.

That view is wrong.

In fact, the best way to save multiple percentage points on outbound shipping is through arbitrage across multiple carriers and methods.

It is proven that arbitrage still saves the maximum amount of money, regardless of whatever a carrier sales rep tells you.

How major brands streamline their outbound logistics

We learned a lot from our experiences at Amazon and Zulily where we built the systems that power their real-time carrier selection. One side effect of building these programs for large companies is the statistically significant data-drive experiments we could run. Time and again, integrating effective arbitrage into their outbound logistics activities yielded higher savings.

Yet, bringing this outbound shipping strategy to an ecommerce company that may not have the resources of Amazon is a bit tricky. The following needs to happen, which can be a resource drain:

- Find and secure multiple carrier contracts comprising multiple methods.

- Explore and then secure specialized rates depending on your specific business context. (e.g., If you have a large SKU count and ship many types of box sizes and weights, USPS rates might be better for < 1lb boxes while UPS might be better for 10lb > 1lb boxes while FedEx might be better for >10lb boxes. It’s all variable!)

- If multiple FCs, instantiate those carrier rates across diverse geographical zones. (e.g., USPS ReadPost might be best for 2-day shipping in the Northeast, but FedEx 2-Day might be better for the Southwest.)

- Available rates need to be digitized at the FC level so that decision making can be automated in real-time.

- Since most contracts have dynamic pricing—for example, fuel rates can change weekly—you need to stay on top of those changes and ensure the software system understands the changes.

That’s a lot of work, which is why we’re sympathetic to decisions simply being “This is our rate table with UPS, we think we got the best rate we could get, so there isn’t more optimization to be done here.”

The good news is that you can get to a mature process involving multiple carriers and methods. The 2%+ in savings will be rewarding if you do.

How to reduce the cost of outbound shipping

Substantial savings on your outbound shipping costs begins with having options. When done appropriately, you are guaranteed to see a cost savings of around 1%-2%. Depending your initial baseline, you might see cost savings at 5% or higher.

Here are five steps to follow:

1. Audit your inventory

Start by charting out your SKU portfolio and the types of package dimensions you expect to use. Standardizing on one type of box always under 1lb? Or will you have a broad collection of box sizes and weights?

2. Map out your delivery promises

Next, chart out how fast you want to deliver. Consumers generally expect fast and free shipping — a big factor in overall customer experience. It’s to your advantage to ensure understand how much margin your willing to give up for speed. Then, chart out the location of your FCs and where your customer density is.

Certain carriers might have better rates to Northeast zones compared to the Southwest. Some carriers might work better if the movement of goods is long distance across the country vs fast local routes.

3. Review your carrier contracts

With the charts in hand, map out which existing carrier contracts you have are optimized for which parcel types, speed configurations, and geographical rules. You might see gaps, or you might not, depending on what you already have set up. Chances are, there are areas to improve, which this new matrix will highlight.

For any part of the matrix where you don’t have an optimized carrier method and rate, make those a priority. Source options from other carriers, or talk to an existing carrier about a new method type.

For those where you have an existing carrier method and rate in place, make those a secondary priority. Basically, having a second option on hand for a given shipment type is beneficial when there are differences at the margin, i.e. based on package dimensions, geography zones, or dynamic fuel pricing.

3. Refine your carrier selection

Once you finally get all the rates in place, the next initiative focuses on exposing them for real-time tracking and decision making. This is where the arbitrage happens.

The key is to build a software system that takes in all your variables. The system must allow for dynamic changes (e.g., fuel rates changing weekly, or new package sizes added to the mix).

4. Integrate frontend and backend systems

With the system built, integrate it with your frontend ecommerce store (e.g., Magento or Shopify), your warehouse management system (WMS), your inventory management system (IMS), your transportation management system (TMS), and your fulfillment network.

Once integrated, build logic at the order-created point so that the logic looks at all integrated systems and makes a real-time decision of which method to select.

Avoid these traps when refining your outbound shipment process

The first collection of gotcha’s center around acquiring contracts.

- Pay attention to the differences in contracts. Meaningful cost savings can only happen with arbitrage at scale, which means differences must exit. If you have identical contracts, then there is little value found.

- Consultants who pitch 10%-30% in savings are often disingenuous. Those cost savings can only be found at massive volumes (think: Walmart level). By the time you’re done paying fees, it’s about a wash compared to having negotiated with carriers directly. On top of that, owning your relationships with carriers is a muscle you should exercise in-house.

- Make special note of dynamic pricing aspects of a contract. Fuel charges are a typical example. They can ruin any cost savings initiative.

- Don’t get lured by volume breakage promises by carrier sales reps. They will try to intimidate you that you’ve secured the best possible rate, and the only way to get that rate is giving throwing all your volume to them. Volume discounts are nice, but they won’t save as much in the long run.

The other collection of gotcha’s comes on the software side.

- The ability to make real-time decisions is the key bottleneck to this playbook. “Real-time” means under a minute. Whatever software is used to select the best method must talk to all other systems and make a calculation in roughly less than 30 seconds.

- The more nodes in your graph, so to speak, the harder the software problem becomes. Each FC location, fulfillment process, carrier, method, SKU, parcel attribute, and destination address will create compound complexity.

- If merchandising a delivery date back to the consumer via pre-purchase and post-purchase communications, be sure that that system is also integrated to the carrier selection software.

- Picking a shipping method isn’t a single dimension. Instead, it selecting a trade off between speed and cost. Shipping everything 10-day Ground is the cheapest possible way to solve this problem, but then customers would be upset! Therefore, part of the policy engine which drives the software decision making is to ensure that speed considerations are factored into the algorithm.

Why shipping metrics matter for operators

For shippers, it’s critical to log detailed shipping metrics, especially the historical analysis of opportunity costs. After a week (or month, or year), you want to know if you have been picking the cheapest possible available method, but the only way to do that is to know the options available at the time of decision.

Similarly, you want to know if the method being selected is being too optimized towards cost versus speed and precision. Therefore, you want to track when packages are being delivered and how consistent the delivery date is on a promised day.

How Shipium helps manage the cost of shipping

The Shipium platform provides automated carrier selection decision-making at the point of fulfillment, taking in account all variables, from fulfillment centers, logistics processes, and transportation costs to contract rates, parcel attributes, final destination addresses, and policies set by you.

Our solutions can be integrated with your existing outbound logistics processes and systems, such as your frontend store and WMS, via APIs. By ensuring the best rate for every order processed, operators typically see a cost reduction of around 2% on their shipping when using our service. What’s really cool is the savings actually scale with volume, so the bigger you get, the more you proportionally save.

Book a demo today and discover how Shipium can help you reduce your outbound shipping costs.