Adding a 2-Day Shipping Program

Who is this for?

Read this if you want to add a 2-Day delivery program that is predictable, profitable, and isn't a static "Send everything FedEx overnight" policy.

Summary

No question that consumer preferences have shifted online. The last several years have seen numerous industry reports demonstrating consumers have an expectation around delivery cost, speed, and transparency, mostly due to the push by big players like Amazon and Walmart. One such example comes from The National Retail Federation (NRF) which published a 2019 study that showed 39% of consumers expect free 2-Day shipping. Many will shop elsewhere if they don't get it.

In general, consumers want either free shipping, fast shipping, or both if they can get it. As a baseline, retailers must provide both fast or free shipping because without those two options, the retailer is unnecessarily killing half their potential market. Providing free shipping is different enough from fast shipping that we'll discuss that program in a different article.

Unfortunately, providing fast shipping isn't easy mostly because it isn't cheap. If it was profitable to do so, everyone would simply ship all orders using a Next-Day method from the big national carriers.

But fear not, it is possible to implement a cost-effective 2-Day shipping program, where the savings are passed along to customers as a form of competitive differentiation.

This play will walk you through what to consider at all stages of business growth.

Overview

Providing a cheap 2-Day shipping option requires management and optimization of all steps along the fulfillment process. Consider these high-level points along the linear lifecycle of merchandise:

- FCs must be placed in smart locations, close to where the majority of your customers are likely to purchase.

- Inventory allocation must be optimized so the right SKUs are closely placed to probable customers.

- Order systems and fulfillment centers, whether owned or 3PL partners, must work together in real-time so orders can be processed without a full 24-hour delay.

- The chosen FC must have the SKUs in stock.

- Fulfillment processes (pick and pack, labor management, etc.) must be in concert with expectations.

- The correct carrier method must be selected.

Getting these points right is how you do 2-Day, but the path to get here is complicated. Let's dive in.

Location matters most

Without a doubt, the placement of inventory is the single most important factor to establishing a cost-effective fast shipping program. A universal rule, which is easy to intuitively understand, is delivery is cheaper and faster the less distance it has to travel.

A thread throughout the plays below is stochastic calculations on what to put where. This is important because it's an upstream and decoupled problem from what you'd expect to be a solution—simply shipping things at a faster method but a cheaper price.

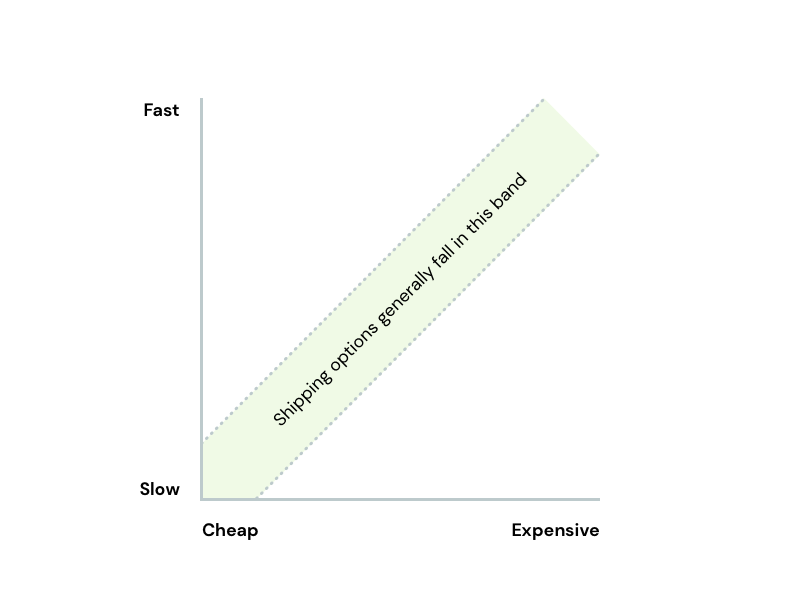

Let's take a look at this simple chart. The price of shipping is either cheap or expensive. The speed of shipping is either slow or fast. In general, deliveries track at a linear rate. Slower is cheaper, faster is more expensive.

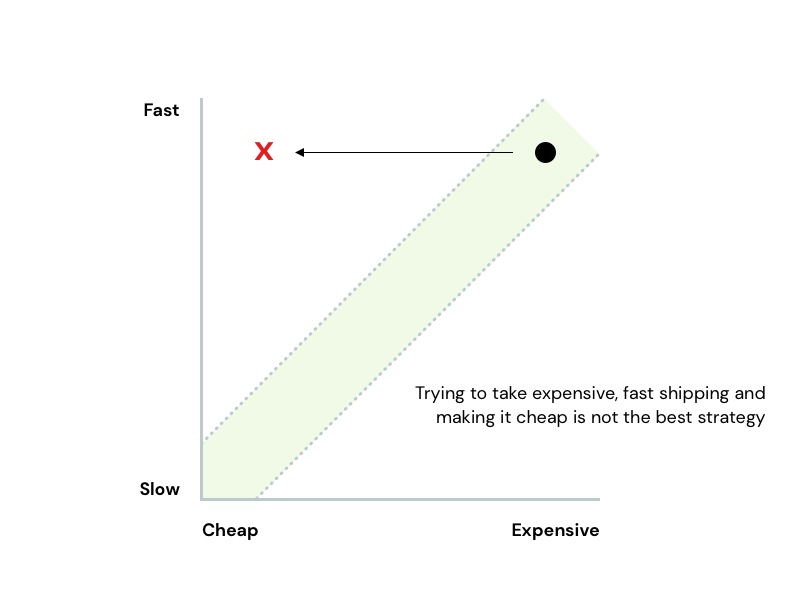

Providing a cost-effective 2-Day shipping program does not mean moving from the upper right (fast+expensive) to the upper left (fast+cheap). It is not as simple as finding some magically cheap Next-Day Air option, for example. Those don't exist!

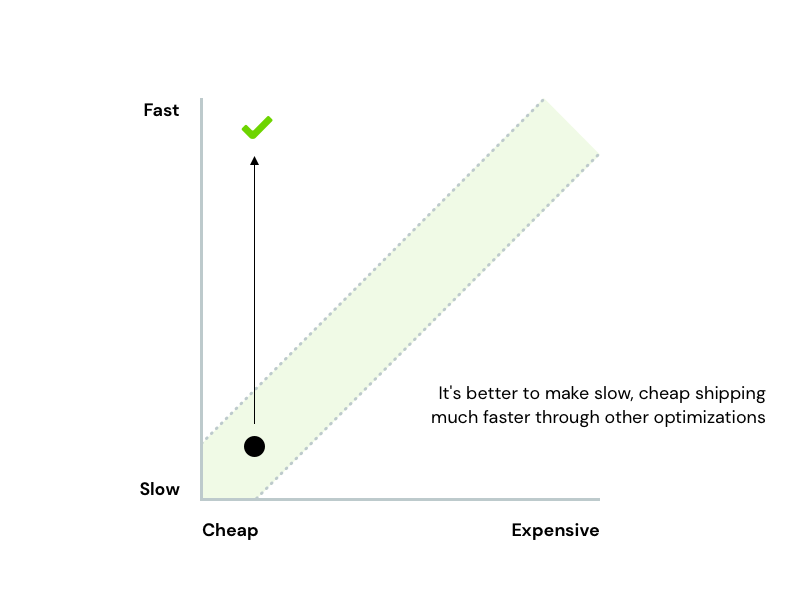

Instead, the best conceptual way to provide a cost-effective 2-Day option is to move from the lower left (slow+cheap) to the upper left (fast+cheap). Yes, that means the profitable way to hit 2-Day shipping is with a slower than 2-Day method. Quite the mental pretzel!

Therefore the key insight is to ask yourself, "How can I provide 2-Day shipping at 3-5 Day Ground rates?"

The answer, usually, starts with inventory placement.

Importance of scale

The larger you are, the easier it is to implement fast or free shipping programs. One thing this article attempts to do, however, is provide solutions which don't rely on an "economies of scale" argument. Few companies have the type of scale needed to solely rely on the slim truth in the joke, "We'll make it up in volume." Many more companies are looking to implement ideas which can help them grow to be that big.

But a little scale goes a lot way.

First, let's define what we mean by scale. Consider thinking about your backend operations as a graph consisting of several nodes, where more nodes means more complexity. The categories of nodes might be SKUs, suppliers, fulfillment centers, carriers and shipping methods, sales channels, or box sizes.

The categories that matter for a cost-effective 2-Day shipping program are fulfillment centers and carriers. Scale, for the purposes of this article, means more than one FC and more than one carrier.

The reasons why are straight forward: The more FCs you have, the greater the chance that all SKUs in an order will be located within Zones 1-2 of the destination ZIP. As for carriers, the more carriers you have, the easier it is to create arbitrage and pick the cheapest method that still hits a 1-2 day delivery window.

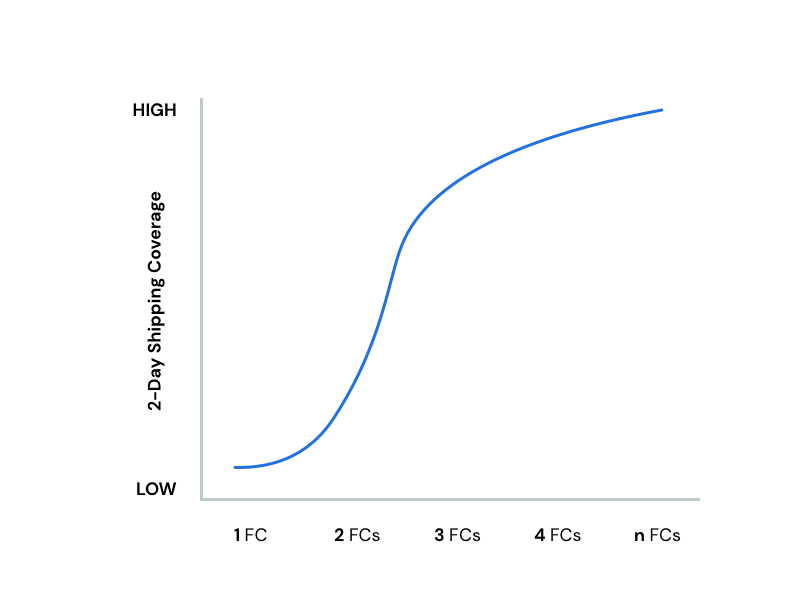

The importance of scale is not linear, though. In fact, it looks a little more like a typical S-curve, where a little scale (e.g., going from 1 FC to 2) makes a tremendous impact, but going from 4 FCs to 5 provides diminishing returns.

SKU composition is an important caveat

Not all products are equal. A few considerations:

- Big, bulky, and heavy products are different. With heavy SKUs, like appliances, local carriers become an important factor. Achieving 2-Day shipping with these types of SKUs will require a local carrier strategy much sooner than not.

- Cold-chain SKUs inherently need faster shipping, so 2-Day network design starts at the beginning. A future article will be published about cold-chain strategies.

- Low SKU count companies generally have an easier allocation decision: put all products in all locations. High SKU count companies have a harder problem on their hands: Placement becomes a forecasting exercise where probabilistic calculations come into play, with the goal of minimizing splits and long-haul deliveries. This situation is a much larger problem out of scope for this article, and will be a separate play published in the future.

The Plays

The most important strategy: location, location, location

If the secret to a cost-effective 2-Day shipping program is to use cheaper 3-7 Day Ground methods but on orders where delivery can still happen in a 2-Day window, then the key to the strategy is expanding fulfillment locations.

It is virtually impossible to build a cost-effective 2-Day shipping program from a single fulfillment location.

One FC generally translates to covering ~50% of the contiguous US, or worse if a the FC is placed poorly. To reach the other half of the population, you would usually need to resort to cost-prohibitive methods like Next-Day Air options.

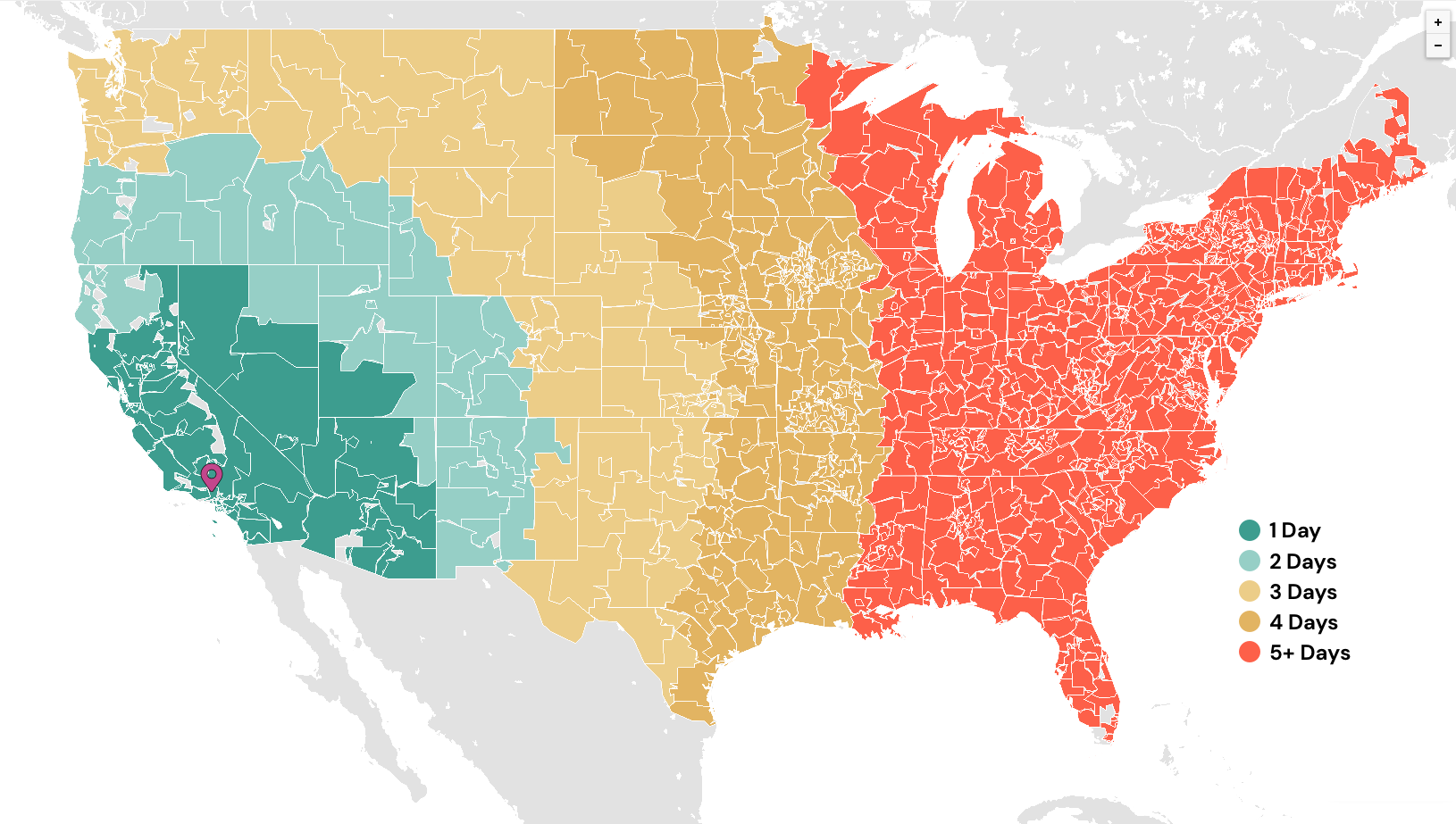

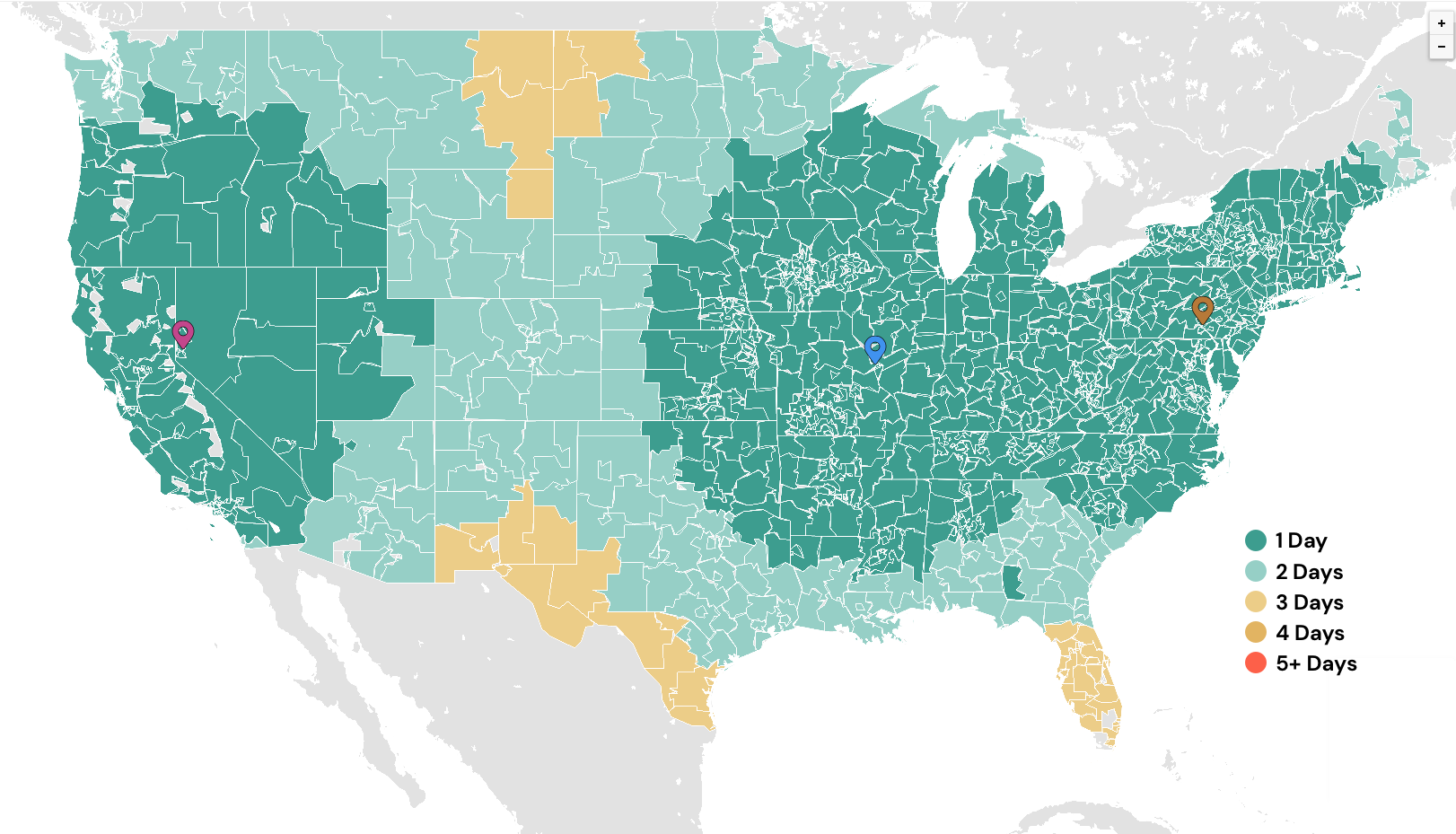

Here is an example map based on a company using the visibility tool on Shipium's platform.

Shipping 2-Day to anything east of the Mississippi River will kill margin.

Two FCs bumps it up to ~70%, and three FCs eventually to ~85%.

Here's the thing though: Opening a new fulfillment location is expensive! We get that. But there are hacks.

Where to start: Anchor on a geographical subset

Chewy.com is one of the best ecommerce success stories. Their origin story has many lessons, but one particular story relates to this play.

Shortly after Chewy's initial bit of success, they shifted towards owning their entire fulfillment stack to profitably manage the rapid scale ahead of them. They knew that certain customer experiences would only fit customers geographically close to where they opened new fulfillment centers. So they started with a single FC that only provided 2-Day shipping to customers within close proximity to the FC. Those customers were offered a cost-effective 2-Day option on the website at the moment of purchase, while other customers were not.

By isolating a geographical roll out, Chewy was able to optimize processes to that single FC, which made scaling to more FCs easier. Then, they methodically opened a second FC, then a third, and so on which gradually increased the pool of customers who could get cost-effective 2-Day shipping.

We may not all be Chewy, in terms of growth and available resources to build fulfillment centers. But we can apply this lesson to building an initial 2-Day program.

Consider starting with a geographical lock on 2-Day availability. Only offer cheap (or free) 2-Day shipping options to customers who are close enough to the fulfillment centers where 2-Day can be met with cheaper 3-7 Day type methods.

How to start: Shadow Mode

Shipium strongly believes in the principle of marketing teams empowered to merchandise the innovations of operations.

Sometimes it makes sense to test internal processes and gather data on a new innovation before merchandising it publicly, however.

Providing a cost-effective 2-Day shipping program is an example. Get a consistent outcome before aggressively marketing it to customers.

We call this shadow mode where you set up the program based on hypotheses and new processes, then simply run it for a while to see how you perform. You might do great, or you might find issues that need to be fixed before offering the option publicly.

Consider a shadow mode to start.

Policy first, optimization second

At Amazon, we often deployed an approach to problems where progress came before optimization. Adding a 2-Day shipping program is a good example.

It's best to commit to the policy and follow through regardless of costs or exceptions. The commitment will highlight areas of improvement that will lead to smoother automation. Only then will cost savings scale.

People will sometime jump to the optimized automation use case right away, or, worse, if that use case is immediately unattainable, they won't even start the project. But that thinking is backwards, as it proved true time and again that building and measuring a manual process is how true efficiency, optimization, and automation happens.

Let's put the idea into practice and talk about the concept of a policy.

Assume you now offer a 2-Day shipping option to customers. Those who convert and pick the 2-Day option will be expecting it.

Carry the 2-Day promise through all fulfillment and delivery steps, even if problems occur which make it cost prohibitive.

For example, let's say you have a West Coast and East Coast FC. A customer in Pittsburgh places an order with 2-Day shipping where the SKU was out of stock in the East Coast FC. Instead of either (a) not hitting the 2-Day promise by waiting for the SKU to be in stock at the East Coast FC, or (b) shipping from the West Coast FC but not hitting the 2-Day promise by falling back to a cheaper shipping method in order to maintain margins... you should upgrade shipping to Next-Day from the West Coast FC and eat the margin. It's generally never a good idea to violate policy at the individual-order level in an effort to save a few dollars. Doing so stunts your ability to gradually optimize for true cost-effective scale. Missing the forest for the trees, so to speak.

First, committing to the policy maintains customer loyalty. Going back to ask the customer to pay more for shipping, or instead not hitting the 2-Day window as promised, is a one-way ticket to losing loyalty. A 2018 Pitney Bowes survey showed 36% of consumers never return to an ecommerce merchant after one negative buying experience.

Second, the root problem to solve is the issue of being out of stock and inventory availability out of sync with frontend systems. By falling back to exception management meant to reduce costs, you are papering over the real problem to solve. Instead, now the pain is felt and there is business incentive to go solve the actual problem causing downstream issues.

Establish a Click-to-Deliver metric to start a virtuous cycle

What matters to a customer is when they receive the order after they click the "Buy" button. You need to track that flow as a new metric usually Order-to-Delivery but sometimes restated in ecommerce as Click-to-Deliver.

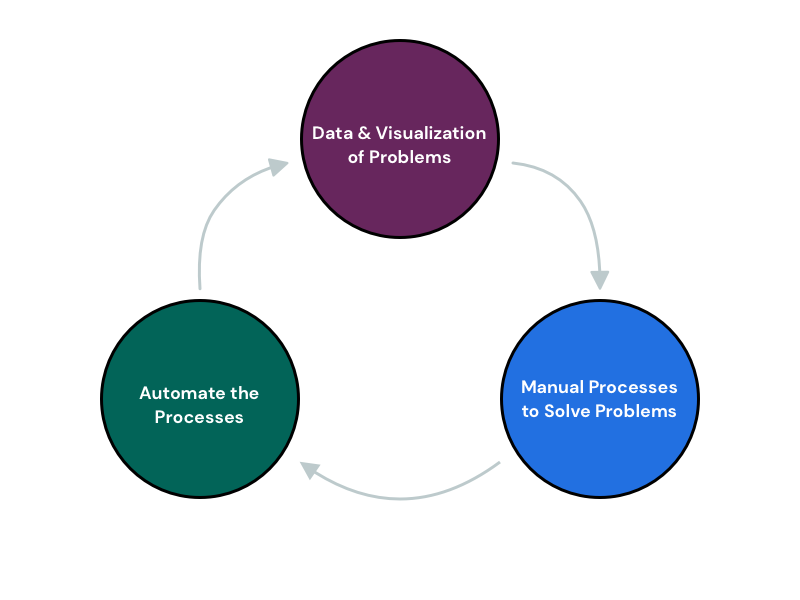

Doing so kickstarts a virtuous cycle we employed a lot at Amazon.

Gaining visibility into performance and collecting data is the start of the cycle. If you plan to offer a cost-effective 2-Day shipping program, you need visibility into all systems from the moment the order is purchased to the moment the order is delivered. The composite view across systems will tell you if you're hitting your external promise while maintaining internal cost structures.

Once you have visibility, it's possible to identify true bottlenecks or issues. Ops teams can then isolate problems and create manual processes to solve the problem.

Once the problem has been solved in a manual capacity, then the ops team can progress towards figuring out how to automate the manual process.

Then the cycle starts anew. Visibility will highlight the next bottleneck, which the Ops team addresses, then automates, and so on.

After initial FC and carrier setup, this process is quite possibly the most important tool for long-term scalable growth of a fast shipping program.

A word about marketplaces

The play so far has been exclusive to retailers or brands managing ecommerce fulfillment. Marketplaces and drop shippers are two different enough business models that they need some additional recommendations.

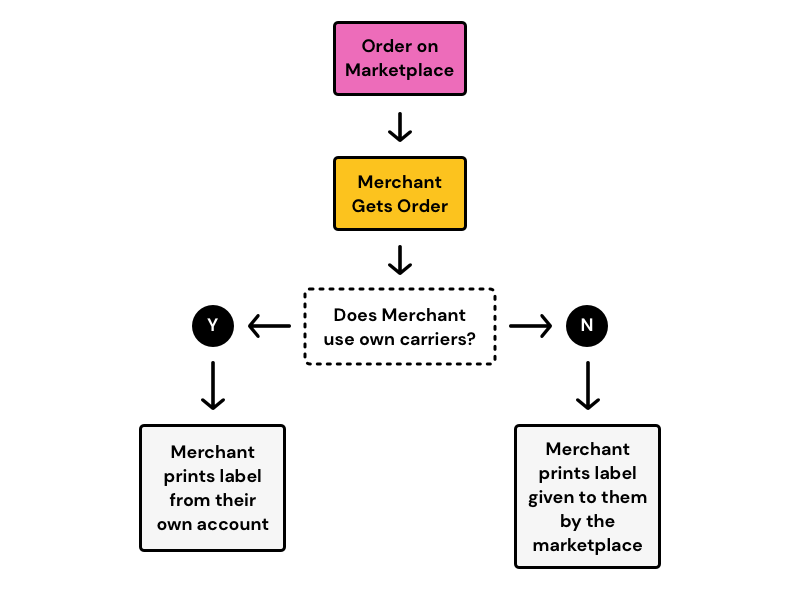

The greatest challenge for marketplaces is the handoff to the merchant partner. In most cases, marketplaces will push an order down to the merchant partner, then rely on the merchant to fulfill the order and hand off to a carrier for delivery. Sometimes the merchant uses their own carrier relationship to print their own label, while sometimes the marketplace pushed down the label along with the order information to the merchant.

From the customer's point of view, the marketplace is fulfilling the order. A 2-Day delivery option is associated to the marketplace's brand promise. Failure to deliver will reflect poorly on the marketplace.

But marketplaces inherently have little control on the fulfillment step as an order is passed to the merchant. And unlike the similarities of passing fulfillment over to a 3PL partner, marketplaces are a federated group of merchants who all have different backend operations. Some might be sophisticated (like, say, Fjällräven on Amazon.com). But some might be small (like, say, Rose & Rex selling Loog Guitars on Maisonette.com).

The best way for marketplaces to implement a cost-effective 2-Day shipping program is to take many of the tenants discussed so far, but tweak them to the specifics of a marketplace model.

Here is an example of Amazon to illustrate the point.

When Amazon launched the marketplace, no merchants were initially included in Prime because it wasn't assured merchants could meet the SLA requirements for a Prime delivery experience.

So Amazon launched a "shadow mode" approach at the merchant level. Any merchant interested in being included as a Prime option could enroll. Amazon then collected fulfillment data to stochastically model out how predictably a merchant could meet the speedy fulfillment requirements. Amazon measured "click-to-deliver" timing on these merchants, and if they consistently met the Delivery Promise pushed to them (Next-Day, 2-Day, 3-Day, whatever was contextual to the order), the merchant could be trusted to be Prime-eligible.

Marketplaces should proceed with a similar plan. First, create a system which allows for merchants to potentially fulfill on the 2-Day timeframe. That includes measuring and managing merchant fulfillment turnaround, but also for the marketplace to offer 2-Day shipping labels for merchants who don't have a similar carrier method available.

Then collect data over time until some threshold is met that demonstrates the merchant can be included in a 2-Day shipping option.

Typical approaches based on FC and carrier posture

It should be self-evident by now how different a 2-Day shipping program is approached when one FC and one carrier versus many of both, but the following highlights best practices specific to the common combinations found throughout stages of ecommerce growth.

1 FC, 1 Carrier

Margins matter the most in this case. It is not impossible to build a program with a high-margin product with a favorable shipping profile. DTC jewelry stores shipping small light boxes have a chance while heavy and bulky pet food stores less so.

Some vendors who specialize in this use case can help fill the gap at this stage. For example, Shoprunner.com is effectively 2-Day program for brands who are comfortable with it's delivery model. Worth taking a look if you are in this segment.

Employing a geographical lock is the best approach here. Simply put, it's probably smartest to offer a cost-effective 2-Day shipping program to customers close to the one FC. If anyone else across the country needs expedited shipping, you might want to consider offering 2-Day shipping but sharing the method upgrade cost with the customer.

1 FC, 2+ Carriers

Companies tend to add new carriers before they add new FCs. The capital investment is obviously much lower, and the process simpler. Someone companies in this segment might even get up to three or four additional carriers before adding a second FC.

The approach is similar to 1 FC / 1 Carrier, but now many more opportunities exist for arbitrage across carrier methods. Depending on your shipping profile and carrier contracts, the radius of customer proximity through a geographically-locked strategy will probably expand a bit.

Check out this play on Adding a New Carrier for more insight on this topic.

2 FCs, 2+ Carriers

It is fairly rare for companies to go to multiple FCs without having at least two different shipping methods in place, let alone two different carriers. One reason is most 3PL partners can offer multiple carrier options, too.

With two FCs in place, the options expand a lot. You may still opt to keep a geographically-locked approach in place, but it is greatly expanded to close to three-fourths of the population.

Chances are the combination of multiple FCs and multiple carriers will provide the chance for arbitrage at the order level. You should consider investing in technology that makes real-time shipment generation decisions which optimizes for this situation.

3+ FCs, 3+ Carriers

Now we're getting to scale. The principles articulated in this article are much easier to implement. The challenge, though, is even if it's easier, that doesn't mean it's simpler!

In fact, jumping to this type of scale actually makes the real-time decision making harder and downright impossible without sophisticated software. Consider the following scenarios in play which weren't as common at a smaller scale:

- Shipment splits. SKU#123 might be at FC1 and SKU#789 might be at FC2. How do you decide shipment generation that can still honor a 2-Day shipping promise in a cost-effective way? How are your frontend systems, from the store itself to post-purchase customer communications, synced with the shipment generation decisions?

- Different FCs and different carriers might have different cut-off times. Since so much of meeting a 2-Day promise requires efficient fulfillment processes that gets an order staged for shipping as fast as possible, how do you balance those constraints? For example, maybe shipping the order from FC3, which is farther away from the customer than FC2 or FC1, is better because the order can still be fulfilled and shipped today thus hitting a 2-Day promise, even though the cost ends up only a dollar more for the order.

- Maybe invested technology (let's say, robots or conveyor automation) is better at one FC while the others are still implementing those investments. The more efficient FC is farther away from the customer, but it turns out it's cheaper and faster for the order to be fulfilled from this FC. How do you make that calculation?

- Oh no! There is a massive Nor'easter storm causing massive blizzard delays out of the New Jersey FC. How do you adjust fulfillment to come out of the other FCs in order to maintain 2-Day promises?

- Another complexity node—box sizes—might come into play. It turns out one FC has a different box makeup than another FC, and a particular order is actually cheaper shipping in a different sized box from farther away. While less common of a condition, it's the kind of situation found at the fringe that matters as you scale.

The commonality is more decision have to be made across variable conditions, all in real-time, all with costs and promises to customers to balance.

Gotchas

- Fulfillment centers, especially if using a 3PL partner, have the potential to be the biggest bottleneck. An inability for the FC to process orders fast enough and stage for shipping can kill a cost-effective 2-Day promise. If it takes more than a day for the FC to fulfill the order, your method options are limited. Therefore, establish and track tight SLAs with them.

- Sometimes, a 2-Day delivery will include air freight within there. If you are forced to use ground, it an be physically impossible to keep a 2-Day promise without close order proximity.

- Product types can limit scope, but in ways you might not be thinking. While SKUs like perishable food or bulky appliances pose intuitive problems, there are categories like batteries or sharp objects that can accidentally slow down fulfillment due to additional safety checks and protocols.

How Shipium Helps

Shipium helps be the glue in a complex multi-nodal network. As companies (retailer, 3PLs, whoever) manage fulfillment processes, real-time decision making becomes the make-or-break point as to whether a 2-Day shipping program is consistently hit, and in a profitable manner.

The platform provides services that sit in between order management systems and fulfillment processes to ensure that shipment generation is conducted in a way that optimizes for speed and cost, carrying the 2-Day promise all the way through.